Calculating federal income tax per pay period

These are the rates for. For example if you received a tax refund eg.

Payroll Taxes How Much Do Employers Take Out Adp

That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period.

. Adjust the employees wage. The expected tax withholding is projected by multiplying the anticipated number of remaining pay periods you have for the year with the. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

Your bracket depends on your taxable income and filing status. The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number of allowances both of which are reported. 2020 Federal income tax withholding calculation.

For jobspensions that you currently hold. How It Works. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Subtract any deductions and. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. We suggest you lean on your latest tax return to make educated withholding changes. Our online Weekly tax calculator will automatically work out all your deductions.

There are seven federal tax brackets for the 2021 tax year. Subtract 12900 for Married otherwise. This number is the gross pay per pay period.

Estimate your federal income tax withholding. If the academic term begins or ends at any point within a pay period the entire pay period is eligible for the exemption from FICA. Weekly 52 paychecks per year Every other week 26 paychecks.

Up to 32 cash back Using Worksheet 1 on page 5 we will determine how much federal income tax to withhold per pay period. How Income Taxes Are Calculated. 1400 take that refund amount and divide it by the.

For example if an employee makes 40000 annually and is paid biweekly divide their annual wages 40000 by 26 to get their total gross pay for the period 40000 26. Use this tool to. Federal Income Tax Deductions.

See how your refund take-home pay or tax due are affected by withholding amount. Back in the worksheet on line 3a enter the amount in Step 3 of the W-4 and divide by the number of pay periods. 10 12 22 24 32 35 and 37.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. 4000 26 15385 The employees FIT amount per paycheck of.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

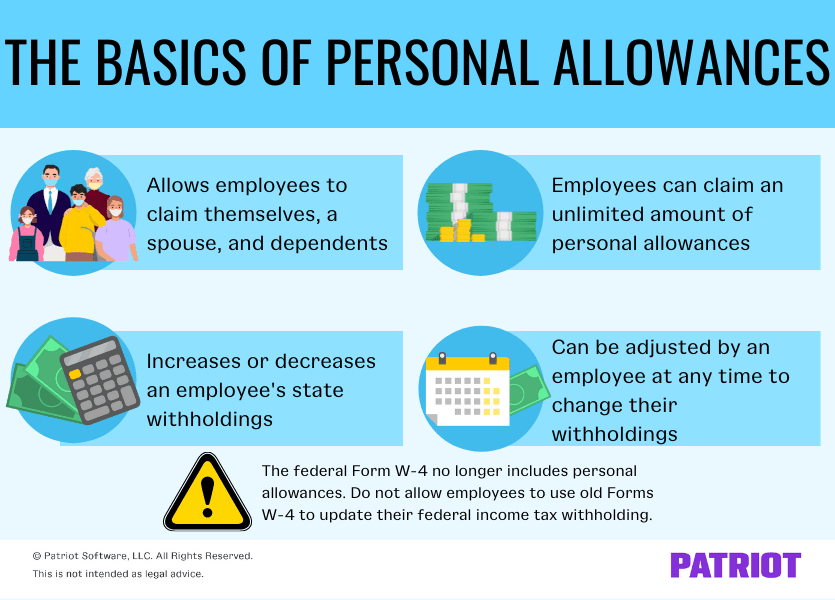

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

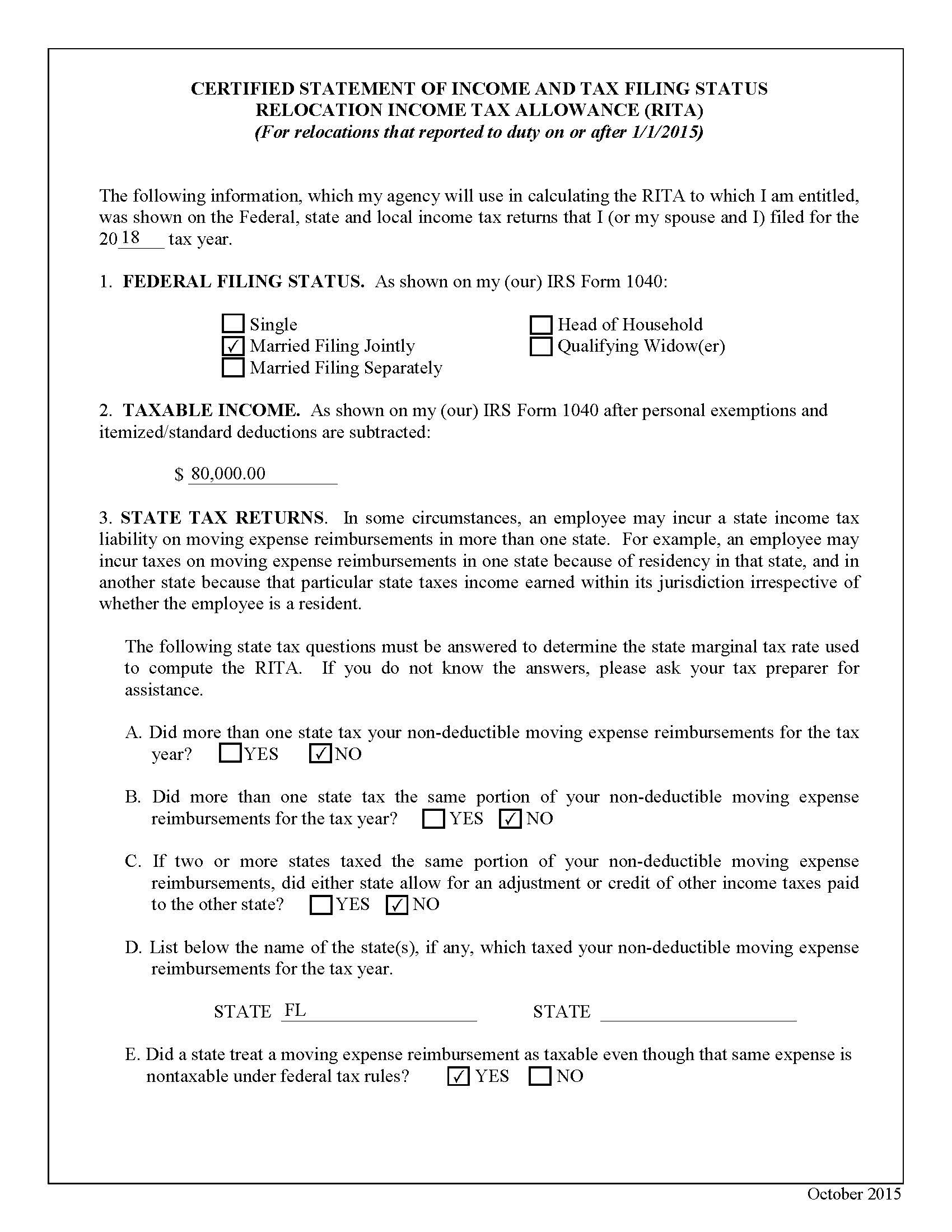

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

2022 Federal State Payroll Tax Rates For Employers

How To Calculate Federal Income Tax

How To Calculate Federal Income Tax

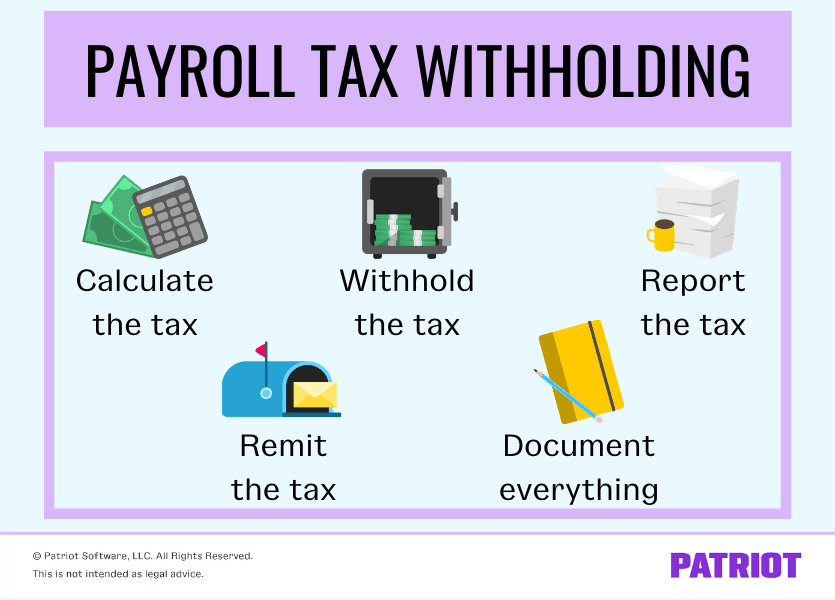

Personal Allowances What They Are What They Do Who Uses Them

Excel Formula Income Tax Bracket Calculation Exceljet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Federal Income Tax

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Federal Income Tax

What Is Local Income Tax Types States With Local Income Tax More